Investors push into healthcare property

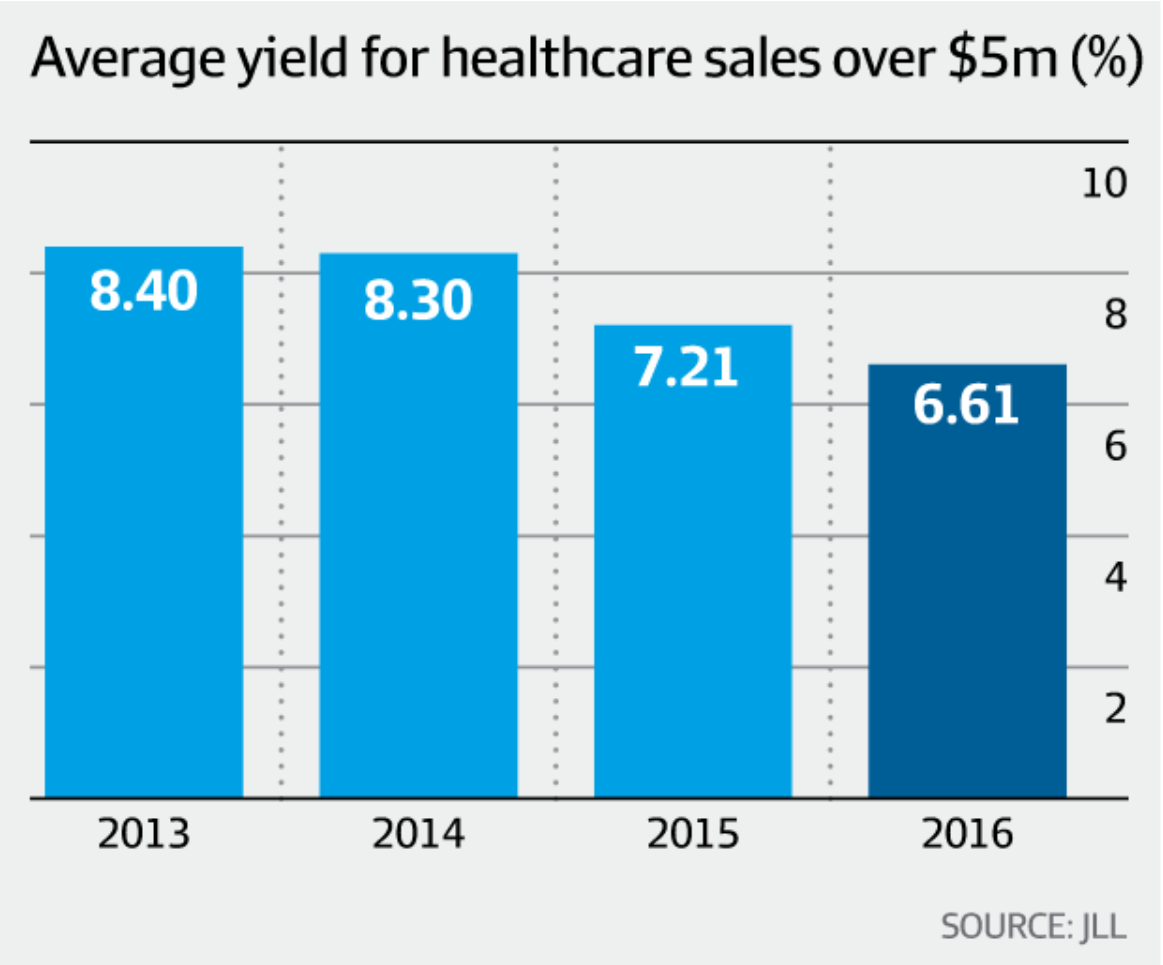

Healthcare property, a fast-emerging component of the mainstream commercial property market, is nearing a peak in values as a broader range of investors push into the sector. Yields in the sector have steadily been squeezed over the last four years, from 8.4 per cent in 2013 to 6.61 per cent in 2016, according to JLL. "The market is moving towards its peak and we are expecting a moderate tightening of yields in 2017, with yields for sub-prime assets in the 6 per cent to 8 per cent range and prime assets being in the 5 per cent to 7 per cent range," said JLL's head of social infrastructure, Noral Wild. "Interest will remain strong in the sector with Australian real estate investment trusts continuing to search the market to further grow their portfolios and fulfil the appetite of retail investors."

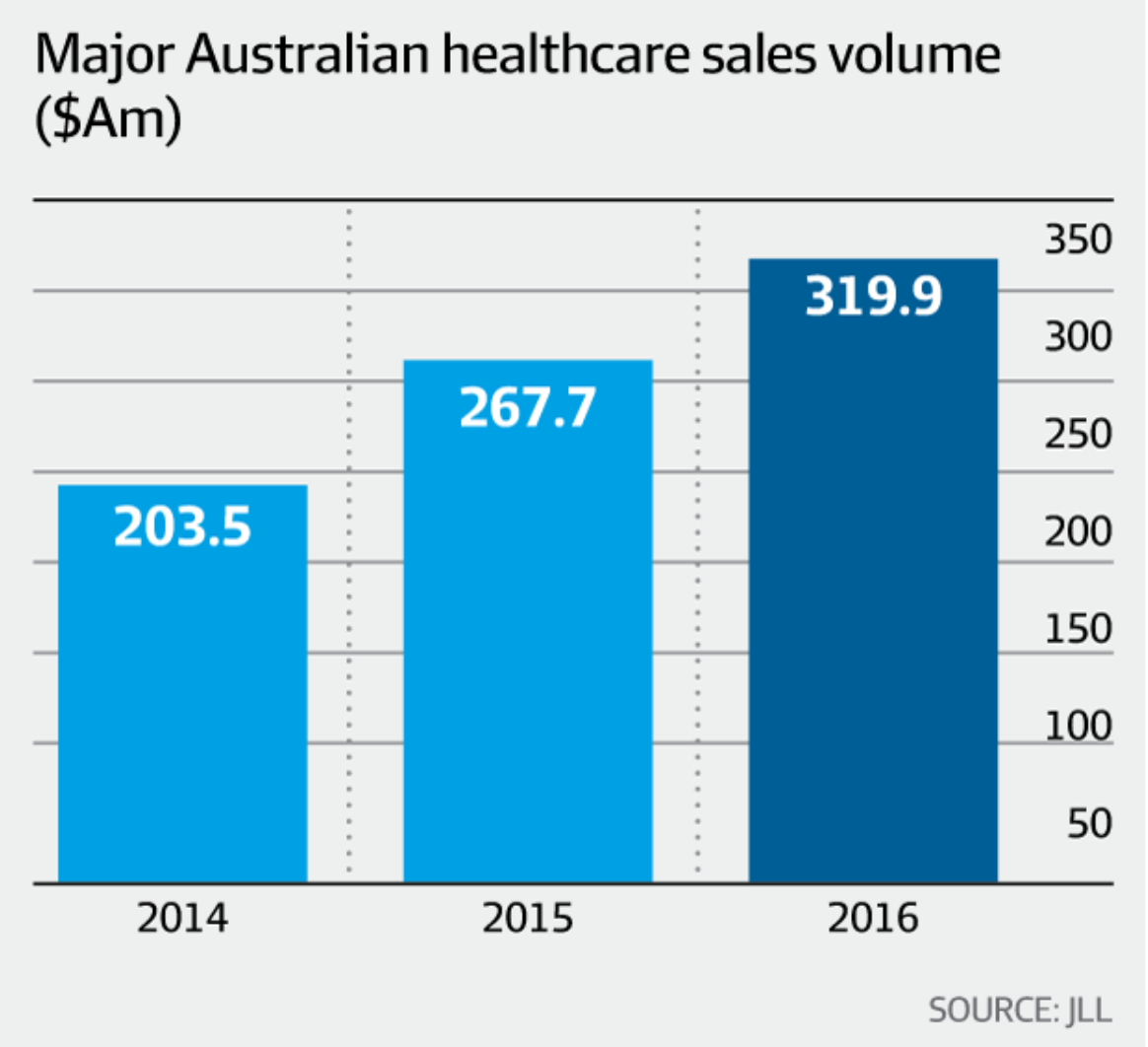

The JLL analysis of the sector is based on sales above $5 million and notes the resilience of the healthcare sector during the global financial crisis. The lack of quality stock on the market has also played a role in tightening yields. Even though no private hospitals were sold in 2016, the amount of healthcare property sales surged to record a high of $319.9 million, according to JLL. Three years ago, transactions struck on yields below 6 per cent were rare. By last year, medical centres were changing hands at 6 per cent yields and below.

Notable deal

One notable deal was the $42 million sale of the GP Plus Healthcare Centre at Elizabeth in Adelaide to new entrant Dexus Property Group on a 5.78 per cent, according to JLL. Dexus has also struck a deal to develop a 128-bed hospital in Sydney's St Leonards, which Ramsay Health Care will operate. Dexus is not alone as large players, both listed and wholesale, move money into the sector. As revealed by The Australian Financial Review, Sydney-based investment manager Barwon Investment Partners has launched a $500 million healthcare property fund for wholesale investors.

Barwon seeded the new fund with a Melbourne pathology facility in a $20.5 million deal this month. Listed medical property landlord Generation Healthcare REIT is steadily expanding its portfolio as well, with major developments underway in Victoria. Last year, Generation made a $29 million investment in the Epping Medical Centre in Melbourne's north. Another big player is New Zealand's Vital Healthcare, which has a $900 million portfolio, the majority of it based in Australia.

See original article at:

https://barwon.net.au/wp-content/uploads/AFR-21-Feb-2017.pdf